When Should You See a Financial Advisor?

Here are some signs that it might be time to seek professional help:

-

You’re juggling multiple credit card payments and high-interest loans.

-

You’re unsure how to budget or create a debt repayment plan.

-

You feel stuck in a cycle of debt with no clear way out.

Is a Financial Advisor Worth It If You’re in Debt?

Many people avoid financial advisors because they don’t want to discuss their money problems with a stranger. But if you’re struggling with debt, a financial advisor might be exactly what you need.

Do You Need an Advisor, or Can You Manage Debt Alone?

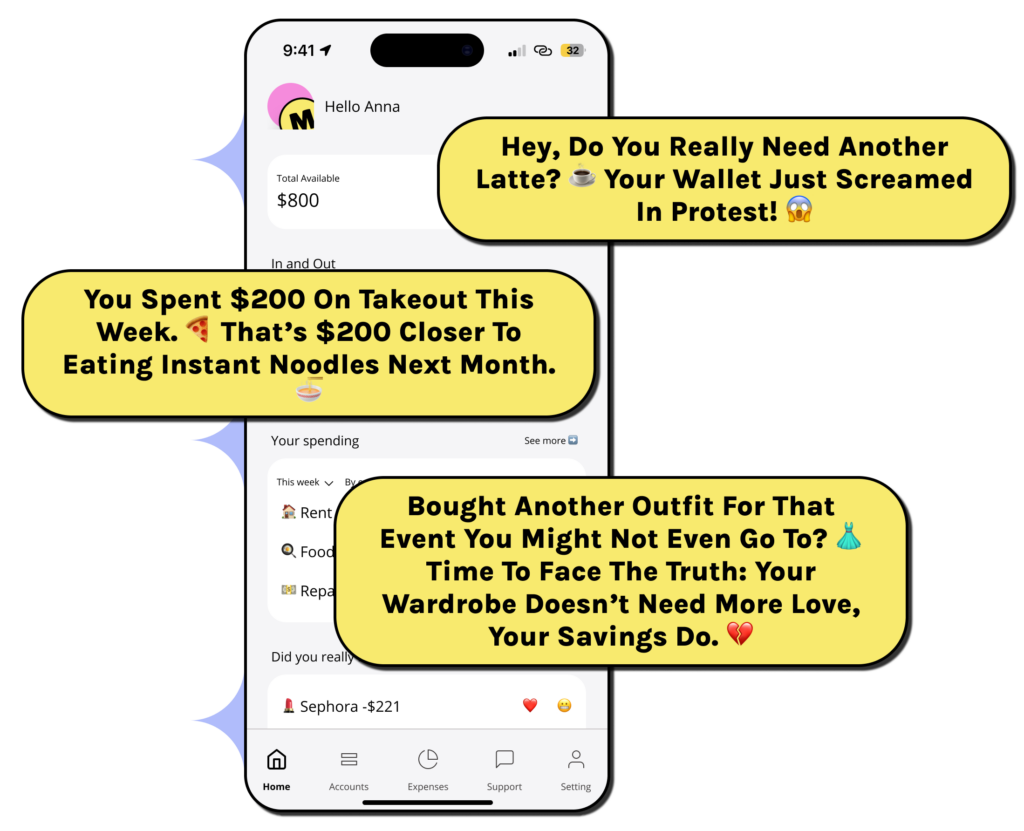

Not everyone is comfortable discussing finances with an advisor. If you prefer a private, judgment-free way to manage debt, apps like Moneta Lend provide automated financial insights without human interaction. These tools analyze your spending, suggest changes, and keep you accountable without requiring you to disclose sensitive details to a financial professional.

Pros and Cons of Using a Financial Advisor

| Pros | Cons |

|---|---|

| Personalized debt management plan | Financial advisors may charge fees |

| Expert knowledge of loan consolidation and refinancing | Requires sharing personal financial details |

| Helps create long-term wealth strategies | Some advisors push products you don’t need |

Can Technology Replace a Financial Advisor?

While financial advisors offer personalized guidance, AI-driven budgeting tools now provide real-time spending insights without the fear of judgment. If you want to keep your financial situation private but need accountability, fintech solutions can be a great alternative to traditional advising.

Final Verdict: Should You Get Financial Advice?

If you’re struggling to manage debt on your own, seeking professional help is a smart choice. But if you prefer a more private approach, fintech apps can help you stay accountable, manage your spending, and create a plan to get out of debt—without ever speaking to an advisor.

FAQ

How do I hold myself accountable for spending?

To stay accountable, track every transaction, set spending limits, and use budgeting apps that provide real-time feedback.

Do budgeting apps really help with financial accountability?

Yes! Apps like Moneta Lend send instant alerts when you make purchases, helping you stick to your budget.

Should I see a financial advisor if I have debt?

If you struggle to manage debt, a financial advisor can help. However, fintech apps now offer private, automated tools for budgeting and debt management.

What are the benefits of tracking my expenses?

Tracking your spending helps prevent overspending, identifies problem areas, and makes it easier to save money.

How can I get out of debt without a financial advisor?

You can use budgeting apps, set clear financial goals, and automate payments to stay on track without hiring a financial advisor.

We would like to acknowledge the Gadigal people of Eora Nation, as traditional owners of the ancestral lands on which our premises stand. We recognise Aboriginal and Torres Strait Islanders as the first peoples of Australia and pay our respects to their Elders past, present and emerging.

© 2025 Moneta Lend. All rights reserved